If you've ever tried to solve your own money problems You'll know how challenging it can be to do it on your own.

That's because we all have a unique level of financial confidence that drives our money decisions, its just that most of us aren't aware of ours.

By discovering your Financial Confidence Score, you'll finally reveal what money means to you, the good, the bad and everything in between.

This is your first step to making clearer, smarter choices that connects your financial life to the life you want to live..... ultimately putting you in control.

And it won't cost you a cent.

Let me tell you a secret…

The more you grow your Financial Confidence, the more your money will grow for you.

After helping literally thousands of women grow their Financial Confidence, this one thing will change everything.

Your Financial Confidence drives your relationship with money. It impacts how you feel and think about your money and how you consistently behave financially.

So, the higher your confidence, the better you feel, the more you do with your money, and the more it will perform and grow for you.

We know life is full of surprises.

Growing your Financial Confidence means that you can better create, plan for and reach your goals. Don't take our word for it ......Take our test and see what your Financial Confidence Score is.

Here are more invaluable insights for you to uncover

Emotions play a much bigger role in money than you might think.

The way you think about money determines how you will act with your money.

Many of us don't ask for what we want because we don't believe we deserve it.

Your family history impacts how you behave with money.

If you don't think you can do it, you won't even try. Most of the time we're the ones holding ourselves back.

If you think you'll always be "bad" with money, you'll keep making the same bad decisions.

39,283

Financial Planning Clients

$472.4M

Managed Finances

5,304

Accountacy Firm

How you know this is for you...

-

You know how to make money, you're successful in your career/business, you don't know how to manage it or keep it.

-

You know you need help but you don't know where to start or who to trust.

-

You are good at saving your hard earned money but are afraid to invest it for fear of lose or making mistakes.

-

You are busy raising a family and building a business but need clarity on the financial numbers and support to succeed.

-

You know how to make money that's not the problem, you just don't know how to invest it or where to start.

-

You're successful in business but when it comes to the finances you keep putting it off or even worse trusting others with your money.

Want to know what's inside?

Let me give you a peek of the four elements that can build Financial Confidence.

Score One

What is my Financial Knowledge?

Your Financial Knowledge is having the ability to understand and apply financial skills. These include budgeting, investing, debt management and wealth protection. When it comes to being the master of your financial destiny and feeling confident to make financial decisions, building your level of financial literacy will help, no matter what life throws at you.

Score 2

What is my Financial Attitude?

Your Financial Attitude are your beliefs about money. How you feel about money? What money means to you? What does it represent? How you perceive money heavily depends on your childhood and the environment you grew up in. The attitudes you formed about money early in life affect how you save, spend and invest today. Think about how your money habits differ from your parents or are they the same? The good news is that money attitude is a learned behaviour and what is learned can be unlearned.

Score 3

What is my Financial Behaviour?

Your Financial behaviour is a product of your financial attitude. The attitude you formed early in life about money is what makes you act in a particular way and defines your behaviour. Money habits and spending patterns are learned over time, that means your relationship with money in the past can influence current and future financial decisions. Attitude determines choice and choice determines results.

Score 4

What is my Financial Wellbeing?

Your Financial wellbeing is about how you manage money and how this affects your life on the whole. It’s about being able to meet your financial obligations, be financially prepared for an unexpected event, able to save for future goals including retirement and having the financial freedom to make choices that allow you to enjoy life – now, in the future and under adverse circumstances.

WHAT THEY'RE SAYING

Just needed to say, WOW!! This week I am analyzing and reanalyzing everything and trying to discover my WHY. Something struck a cord with me on Monday evening, and I haven’t stopped thinking since. You have me talking to myself in the car, in the kitchen and still thinking at 2 o’clock in the morning!!! I’m writing lots of notes and quickly re-connecting with why I do what I do. I’m no-where near finished, but I’ve started and that’s exciting!! So thank you.

Jodie

Small Business Owner

I'm loving your “Financial Confidence” program, it has helped me unlock so many things. I have realised I've been living by my families values. So, I have been so conflicted and hurting wondering why my Mum and Dad don't want to be part of my family. Readjusting my core values to fit my life has really helped me accept that's just the way my Mum and Dad are. It's really freed me up to become the person I want to be and the one I used to be many years ago. I cannot thank you enough for this

Bec

Executive Sales Manager

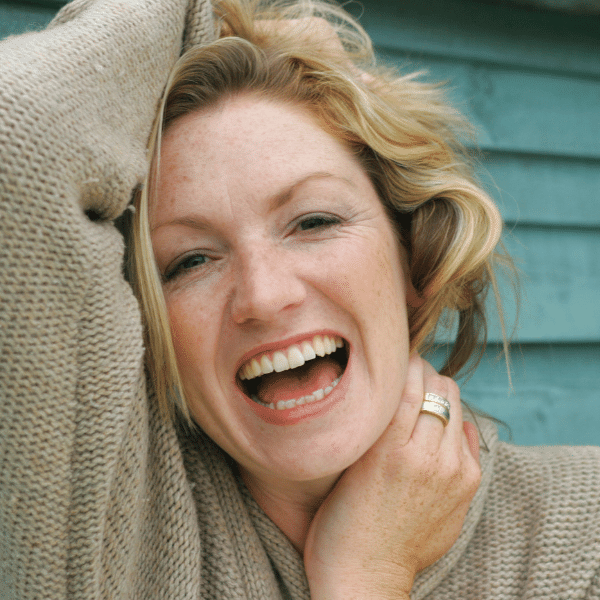

Great to meet you..

I'm Tracey Sofra

CEO & Founder, WOW Women

“My purpose is to empower women in the most impactful area of life-her financial clarity and confidence”.-Tracey Sofra.

We know that women face unique challenges when it comes to money, finance and wealth. Whether you’re new to managing money, a personal finance whizz or wealth master, together we can challenge the status quo and build financial confidence.

... see you on the inside!"

Let's Grow Your Financial Confidence Today!

Designed by Fancy Freedom Copyright © 2021 — Built with GrooveFunnels. All rights reserved.